In the realm of estate planning, the journey to securing a stable future for your assets and loved ones is a crucial one. Finding trusted advisors who can guide you through this intricate process is essential for achieving estate planning excellence.

When it comes to matters as significant as these, the expertise and reliability of your chosen advisors can make all the difference in safeguarding your legacy.

As you embark on this path, the search for the right professionals to entrust with your estate requires a thoughtful approach. Considerations such as specialized knowledge, proven track records, and personalized attention are just a few of the factors that can shape your decision-making process.

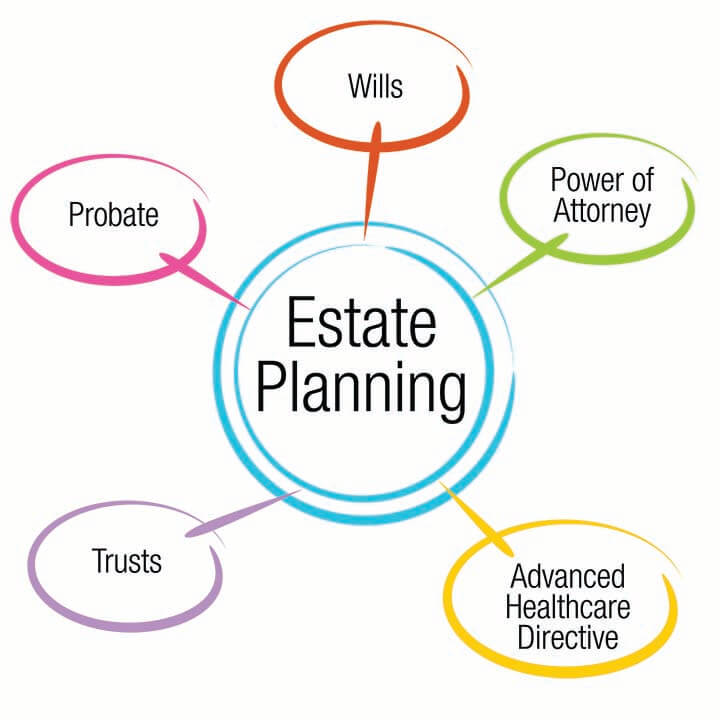

Estate planning excellence is crucial for individuals and families seeking to secure their financial future and ensure the efficient transfer of assets to their heirs. By engaging in thorough estate planning, individuals can outline their wishes regarding the distribution of their assets, designate guardians for minor children, minimize tax liabilities, and potentially avoid conflicts among heirs.

A well-crafted estate plan can provide peace of mind knowing that loved ones will be taken care of according to one's wishes. Moreover, estate planning excellence goes beyond just creating a will; it involves periodic reviews and updates to ensure that the plan aligns with current laws and personal circumstances.

Seeking guidance from experienced estate planning professionals can help navigate the complexities of this process and ultimately achieve a comprehensive and effective estate plan.

How can individuals assess and identify their specific requirements for effective estate planning? To understand your estate planning needs, start by evaluating your assets, liabilities, and financial goals. Consider the size of your estate, including properties, investments, and personal belongings.

Next, think about who you want to inherit your assets and how you wish to distribute them. Factor in potential estate taxes and how they may impact your beneficiaries. Furthermore, assess whether you have any dependents with special needs or unique circumstances that require special provisions.

By taking stock of your financial situation, family dynamics, and personal preferences, you can determine the key components that should be included in your estate plan to ensure your wishes are carried out effectively.

When seeking advisors for estate planning, individuals should prioritize finding professionals who exhibit a combination of expertise, integrity, and personalized attention to detail.

Expertise is crucial as it ensures that advisors have the necessary knowledge and skills to navigate complex estate planning laws and strategies effectively. Integrity is essential for maintaining trust and ensuring that advisors act in their clients' best interests at all times.

Personalized attention to detail is key in estate planning, as each individual's situation is unique and requires tailored solutions. By choosing advisors who possess these qualities, individuals can feel confident that their estate planning needs will be met with professionalism and care.

In the realm of estate planning, individuals should consider various types of trusted advisors to ensure comprehensive and effective strategies for managing their assets and legacies. One crucial advisor to include in estate planning is a knowledgeable estate attorney.

These legal professionals can assist in drafting wills, establishing trusts, and navigating complex legal requirements. Additionally, financial advisors play a vital role in helping individuals make informed decisions about investments, retirement planning, and tax implications.

Accountants are also essential trusted advisors who provide guidance on minimizing taxes and maximizing wealth preservation. Lastly, including a trusted family member or friend in the decision-making process can provide emotional support and ensure that personal values are reflected in the estate plan.

Assembling a proficient estate planning team, comprising estate planning attorneys, financial advisors, accountants, and insurance specialists, necessitates a thorough evaluation of their credentials and experience. When evaluating advisors, consider their qualifications, certifications, and years of experience in estate planning.

Look for specialized expertise in areas such as tax laws, trusts, and asset protection. Verify their professional licenses and memberships in relevant associations. Seek out referrals and testimonials to gauge their reputation and reliability.

It is crucial to ensure that your advisors have a track record of successfully helping clients with similar estate planning needs. By carefully assessing their credentials and experience, you can confidently select a trusted team to guide you through the complexities of estate planning.

To ensure the success and continuity of your estate planning endeavors, cultivating a lasting partnership with your advisors is paramount. Establishing a long-term relationship with your trusted advisors is not just about the initial planning stages but about creating a bond that can adapt to your evolving needs over time.

This relationship should be built on trust, communication, and mutual respect. Regular check-ins and updates can help ensure that your estate plan remains aligned with your goals and any changes in your life circumstances.

By fostering a strong and enduring connection with your advisors, you can feel confident that your estate planning needs will be effectively met both now and in the future.

Estate planning attorneys can assist in planning for digital assets and online accounts by incorporating them into a comprehensive estate plan. They can help identify and catalog these assets, establish guidelines for their management or transfer, and address relevant legal considerations such as privacy laws and terms of service agreements. By including digital assets in the estate planning process, individuals can ensure their online presence is properly managed and protected according to their wishes.

Estate planning attorneys stay current on changing tax laws and regulations through continuous education, attending seminars, workshops, and webinars, and engaging in professional development opportunities. They may also subscribe to legal publications, participate in specialized training programs, and collaborate with tax professionals to enhance their knowledge and expertise. By staying informed about the latest tax laws and regulations, estate planning attorneys can provide clients with accurate and up-to-date advice to ensure effective estate planning strategies.

In estate planning, specific considerations arise for blended families or non-traditional family structures. Ensuring that assets are distributed as intended can be complex due to diverse familial dynamics. Addressing potential conflicts and clearly outlining beneficiaries is crucial. Trusts can be valuable tools to provide for different family members and protect assets. Consulting with a knowledgeable estate planning advisor can help navigate these unique situations and create a tailored plan that reflects individual circumstances.